Federal Reserve Rate Hike: Impact on Mortgages & Spending in 2025

The Federal Reserve’s anticipated interest rate hike in early 2025 is poised to significantly influence US mortgage rates and consumer spending habits, potentially cooling down the housing market and shifting consumer expenditure strategies.

The upcoming Federal Reserve Interest Rate Hike: How Will It Affect Mortgage Rates and Consumer Spending in Early 2025? is a hot topic of discussion among economists and consumers alike, promising potential shifts in financial landscapes across the United States. As we approach early 2025, understanding the implications of this hike becomes increasingly crucial for homeowners, prospective buyers, and retailers.

Understanding the Federal Reserve’s Monetary Policy

The Federal Reserve, often referred to as the Fed, plays a pivotal role in managing the US economy through monetary policy. Its decisions, particularly regarding interest rates, can ripple through various sectors, influencing everything from the cost of borrowing to the rate of inflation. Understanding the Fed’s tools and objectives is crucial before analyzing the impact of a rate hike.

What is Monetary Policy?

Monetary policy refers to actions undertaken by a central bank to manipulate the money supply and credit conditions to stimulate or restrain economic activity. The Federal Reserve uses monetary policy to manage inflation and promote maximum sustainable employment.

Key Tools of the Federal Reserve

The Fed has several tools at its disposal to implement monetary policy, including the federal funds rate, the discount rate, and reserve requirements. Open market operations, such as buying and selling government securities, are also frequently used to influence interest rates and the money supply.

- Federal Funds Rate: The target rate that commercial banks charge one another for the overnight lending of reserves.

- Discount Rate: The interest rate at which commercial banks can borrow money directly from the Fed.

- Reserve Requirements: The fraction of a bank’s deposits that they are required to keep in their account at the Fed or as vault cash.

In summary, understanding the Federal Reserve’s monetary policy tools and its capacity to influence interest rates is vital to anticipating the effects of the impending rate hike on the housing market and consumer spending.

Anticipated Mortgage Rate Changes in Early 2025

One of the most direct impacts of a Federal Reserve interest rate hike is on mortgage rates. As the Fed increases the federal funds rate, interest rates on various types of loans, including mortgages, tend to rise. This can affect both potential homebuyers and current homeowners looking to refinance.

How Rate Hikes Affect Mortgage Rates

When the Fed raises the federal funds rate, banks and other lenders typically increase their prime rates, which in turn impacts the interest rates they offer on mortgages. This increase can make it more expensive to borrow money to purchase a home.

Impact on Homebuyers

For prospective homebuyers, higher mortgage rates can reduce affordability and make it harder to qualify for a loan. This can lead to a decrease in demand for homes, potentially cooling down the housing market.

- Reduced Affordability: Higher interest rates increase the monthly mortgage payment, making it harder for some buyers to afford a home.

- Decreased Demand: As borrowing costs rise, fewer people may be inclined or able to purchase a home.

- Potential Market Slowdown: A decrease in demand can lead to a slower pace of home sales and potentially lower home prices.

In conclusion, the anticipated mortgage rate changes are expected to reflect a direct correlation with the Federal Reserve’s actions, affecting affordability, demand, and market dynamics for potential homebuyers.

Potential Shifts in Consumer Spending Habits

Beyond the housing market, a Federal Reserve interest rate hike can also influence consumer spending habits. Higher interest rates generally lead to increased borrowing costs for consumers, which can impact their spending patterns across various sectors of the economy.

Increased Cost of Borrowing

As interest rates rise, the cost of borrowing money for credit cards, auto loans, and other types of consumer debt increases. This means consumers may have less disposable income available for discretionary spending.

Impact on Retail Sales

With higher borrowing costs and less disposable income, consumers may reduce spending on non-essential items, leading to a slowdown in retail sales. This can affect businesses across various industries, from clothing stores to restaurants.

Changes in Savings Behavior

Higher interest rates can also incentivize consumers to save more money, as they can earn a higher return on savings accounts and other investments. This shift towards increased savings can further dampen consumer spending.

In short, the shift in consumer spending habits as a result of increased borrowing cost is anticipated, affecting retail businesses and savings rates across the nation.

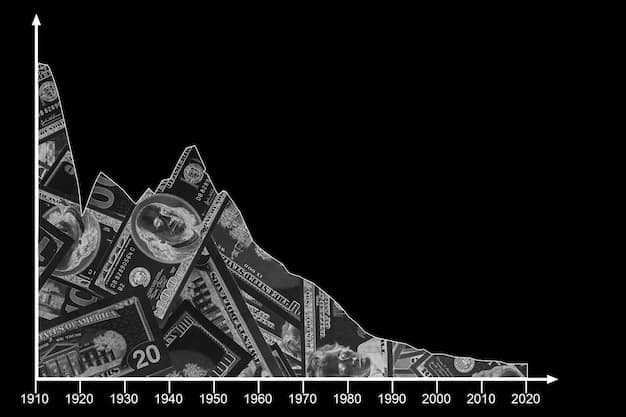

Historical Analysis of Past Rate Hike Impacts

To better understand the potential impacts of the upcoming rate hike, it’s helpful to examine historical data from past instances when the Federal Reserve raised interest rates. Analyzing these previous episodes can provide valuable insights into how mortgage rates and consumer spending have responded in similar economic conditions.

Case Studies: Rate Hikes and Housing Market Response

Review historical data on the effects of previous rate hikes on housing prices, sales volume, and mortgage delinquencies. This can help identify patterns and potential risks associated with the current rate hike.

Consumer Spending Trends Following Rate Increases

Examine how consumer spending trends have evolved after past rate hikes. Analyze changes in retail sales, consumer confidence, and savings rates to understand how consumers typically adjust their spending habits.

- Retail Sales: Analyze historical retail sales data to identify any consistent trends following rate hikes.

- Consumer Confidence: Track consumer confidence indices to determine whether confidence levels tend to decline after rate increases.

- Savings Rates: Review savings rate data to see if consumers tend to save more money when interest rates rise.

Essentially, historical analysis proves useful in understanding how market and consumers may react based on Federal Reserve’s actions.

Expert Opinions and Economic Forecasts

Various economists and financial experts have shared their perspectives on the potential impacts of the impending rate hike. Considering these opinions and economic forecasts can provide a more comprehensive understanding of the range of possible outcomes.

Economist Surveys and Predictions

Gather data from surveys of economists and financial analysts regarding their expectations for mortgage rates and consumer spending in early 2025. Compare and contrast different viewpoints to identify areas of consensus and disagreement.

Impact on Economic Growth

Assess how a rate hike might impact overall economic growth. Some experts believe that a rate hike could slow down economic activity, potentially leading to a recession, while others argue that it is necessary to combat inflation.

Long-Term Implications

Evaluate the long-term implications of the rate hike for the housing market and consumer spending. Consider how these changes might shape the economic landscape in the years to come.

All in all, expert opinions and predictions contribute to a more comprehensive understanding of the possible outcomes regarding the upcoming rate hike.

Strategies for Consumers and Businesses to Adapt

Given the potential impacts of the rate hike, it’s important for both consumers and businesses to develop strategies to adapt to the changing economic environment. These strategies can help mitigate the negative effects of rising interest rates and position individuals and companies for long-term financial success.

Financial Planning for Consumers

Consumers should focus on managing their debt levels, building up savings, and making informed financial decisions. This may involve reducing discretionary spending, refinancing high-interest debt, and diversifying investments.

Business Strategies for a Changing Market

Businesses should focus on cost management, innovation, and customer retention. This may involve streamlining operations, developing new products and services, and enhancing customer loyalty programs.

- Cost Management: Identify areas where costs can be reduced without compromising quality.

- Innovation: Invest in research and development to create new products and services that meet evolving consumer needs.

- Customer Retention: Focus on building strong relationships with existing customers to maintain revenue streams.

In essence, by implementing proactive approach, both consumer and business can better adapt to the rate hike impact in spending power and market changes.

| Key Point | Brief Description |

|---|---|

| 🏠 Mortgage Rates | Expected to rise, potentially impacting affordability for homebuyers. |

| 🛒 Consumer Spending | Likely to decrease due to higher borrowing costs. |

| 📈 Savings Behavior | May increase as higher rates incentivize saving. |

| 📊 Economic Growth | Potential slowdown due to decreased spending and investment. |

FAQ

▼

The Federal Reserve, or Fed, is the central bank of the United States. It manages the nation’s money supply and regulates the banking system to promote economic stability and sustainable growth.

▼

When the Fed raises interest rates, it becomes more expensive for banks to borrow money. These costs are often passed on to consumers through higher mortgage rates, impacting home affordability.

▼

The Fed hikes interest rates primarily to combat inflation. Higher rates can reduce spending and investment, which helps to cool down an overheated economy and keep price increases in check.

▼

Consumers can prepare by reducing debt, building up savings, and carefully evaluating major purchases. This can help them weather the impact of higher borrowing costs and economic uncertainty.

▼

Businesses may need to focus on cost management, improve operational efficiency, and enhance customer loyalty. Diversifying revenue streams and innovating can help them navigate a changing market.

Conclusion

In conclusion, the Federal Reserve’s upcoming interest rate hike is poised to have far-reaching effects on both mortgage rates and consumer spending in early 2025. By understanding these potential impacts and developing proactive strategies, individuals and businesses can better navigate the changing economic landscape and position themselves for future financial stability.