National Debt Ceiling Debate: Potential Economic Consequences

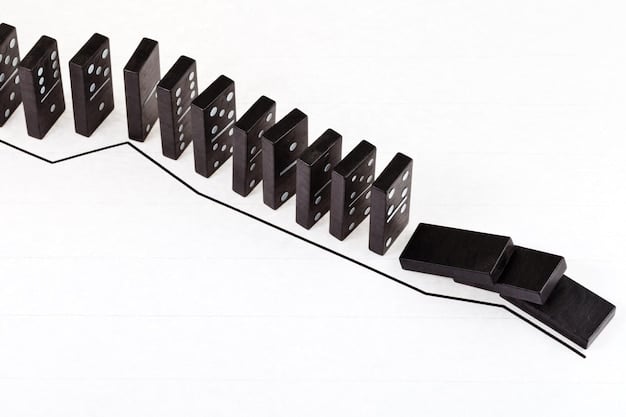

The national debt ceiling debate revolves around Congress’s authority to raise the debt limit, and failure to reach an agreement could lead to severe economic consequences, including a potential default on U.S. debt obligations, impacting financial markets and the global economy.

The national debt ceiling debate: what are the potential consequences if Congress fails to reach an agreement? It’s a question that looms large over the U.S. economy, impacting everything from government operations to global financial stability.

Understanding the National Debt Ceiling

The debt ceiling, also known as the debt limit, is a legislative mechanism that sets a limit on the amount of national debt the U.S. Treasury can issue. This limit includes intragovernmental holdings as well as debt held by the public.

What is the Purpose of the Debt Ceiling?

The debt ceiling was originally established during World War I to facilitate government borrowing. Instead of requiring congressional approval for each individual debt issuance, the debt ceiling allowed the Treasury to manage debt more efficiently, subject to an overall limit.

How Does the Debt Ceiling Work?

When the outstanding debt approaches the limit, the Treasury must take measures to prevent the debt from exceeding it. These measures can include suspending certain investments or disinvesting existing ones, but these are only temporary fixes. Eventually, Congress must act to raise or suspend the debt ceiling.

If Congress fails to raise the debt ceiling in time, the Treasury will be unable to pay all of its obligations, leading to serious consequences.

Here are some key points about the debt ceiling:

- It does not authorize new spending; it allows the government to pay for spending already approved by Congress.

- Raising the debt ceiling is not the same as increasing government spending, but rather allows the government to meet its existing financial obligations.

- The debt ceiling has been raised or suspended numerous times throughout U.S. history.

Understanding these core concepts is essential to grasp the gravity of the debate surrounding the debt ceiling and its potential ramifications.

Historical Context of Debt Ceiling Crises

The history of the debt ceiling is marked by numerous episodes of political brinkmanship and potential economic crises. By examining past instances, we can learn a lot about the patterns, political dynamics, and economic consequences of these situations.

Past Debt Ceiling Standoffs

Several high-profile debt ceiling debates have brought the U.S. to the brink of default. In 1995, a standoff between President Bill Clinton and the Republican-controlled Congress led to a partial government shutdown. In 2011, another contentious debate resulted in a downgrade of the U.S. credit rating by Standard & Poor’s.

Economic Consequences of Past Crises

Even the threat of not raising the debt ceiling has proven to be disruptive to the economy. The 2011 crisis, for example, led to increased borrowing costs and reduced investor confidence. The uncertainty surrounding the debt ceiling can also delay business investments and hiring decisions.

Looking back at these events reveals the risks involved in debt ceiling debates:

- Increased volatility in financial markets.

- Damage to the U.S.’s reputation as a reliable borrower.

- Potential for higher interest rates on government debt.

These historical lessons highlight the importance of understanding the potential impacts of debt ceiling debates on the economic landscape.

Potential Consequences of Defaulting on U.S. Debt

Defaulting on U.S. debt is a scenario fraught with severe and far-reaching consequences. It goes beyond mere financial disruption, impacting trust in the U.S. and the global economy.

Immediate Economic Impacts

A default could cause an immediate spike in interest rates, making it more expensive for the government to borrow money. It can also lead to a sharp decline in stock prices and other financial assets, eroding wealth and potentially triggering a recession.

Impact on Government Payments

If the debt ceiling is not raised, the government may be unable to meet its financial obligations, including payments to Social Security recipients, Medicare providers, and military personnel. Such payment disruptions could have a significant impact on millions of Americans.

Here’s a breakdown of possible outcomes if the U.S. defaults on its debt:

- The value of the U.S. dollar could plummet, affecting international trade and investment.

- Global financial markets could experience turmoil, as U.S. Treasury bonds are considered a benchmark asset.

- The U.S. economy could enter a deep recession, with job losses and reduced economic activity.

These are some of the most serious consequences that could result from failing to raise the debt ceiling. Policymakers and citizens alike must be conscious of these possibilities.

Impact on Financial Markets and Investors

Financial markets and investors are highly sensitive to the national debt ceiling debate. Actions taken in Congress or potential defaults can have a huge ripple effect throughout the U.S. and global economies.

Market Volatility

Uncertainty surrounding the debt ceiling typically leads to increased market volatility. Investors become risk-averse, and trading volumes often surge as individuals and institutions adjust their portfolios in response to the evolving situation.

Investor Confidence

A failure to raise the debt ceiling could significantly damage investor confidence in U.S. Treasury securities. As these are often considered among the safest assets in the world, a default would shatter this perception, prompting investors to seek safer havens.

Here are key considerations for financial markets during this period:

- Credit rating agencies may downgrade U.S. debt, making it more expensive to borrow in the future.

- Yields on Treasury securities could rise, impacting everything from mortgage rates to corporate borrowing costs.

- Foreign investors may reduce their holdings of U.S. debt, further destabilizing the market.

Financial markets will be watching developments closely, and any missteps could lead to severe repercussions for investors and the overall economy.

Global Economic Implications

The implications of the U.S. debt ceiling debate extend beyond national borders, with potentially significant effects on the global economy. As the world’s largest economy, the U.S.’s financial health has far-reaching consequences.

Impact on International Trade

A U.S. default could disrupt international trade flows, as the dollar’s value declines and uncertainty increases. This could harm export-oriented economies and lead to a global slowdown in trade activity.

Effects on Foreign Debt Holdings

Many countries hold U.S. debt as part of their foreign exchange reserves. A default could cause these countries to re-evaluate their holdings, potentially leading to a sell-off of U.S. Treasury securities and further destabilizing financial markets.

Here are several ways a debt ceiling crisis could spill over into the global economy:

- Increased risk aversion among global investors.

- Potential for currency fluctuations and trade imbalances.

- Reduced demand for U.S. goods and services, impacting other economies.

Therefore, the international community has a keen interest in seeing a smooth resolution to the U.S. debt ceiling debate.

Potential Solutions and Political Maneuvering

Resolving the national debt ceiling debate requires careful negotiation and compromise. Both Democrats and Republicans often employ political maneuvering, leading to complex and drawn-out negotiations.

Possible Compromises

Some potential solutions involve a combination of raising the debt ceiling and implementing future spending cuts. Other proposals include reforms to the budget process or even abolishing the debt ceiling altogether.

Political Strategies

Both parties use the debt ceiling as leverage to achieve their respective policy goals. Republicans often seek spending cuts in exchange for raising the debt ceiling, while Democrats aim to protect social programs and invest in infrastructure.

Here are possible strategies politicians could deploy:

- A bipartisan agreement to raise the debt ceiling in exchange for modest spending cuts.

- A short-term extension to allow more time for negotiations.

- A suspension of the debt ceiling until a later date.

The political dynamics make it challenging to predict the ultimate outcome, but compromise is essential.

| Key Point | Brief Description |

|---|---|

| ⚠️ Default Risk | Failure to raise the debt ceiling could lead to a U.S. default. |

| 📉 Market Impact | Financial markets may experience increased volatility and uncertainty. |

| 🌍 Global Effects | Global economy can suffer from trade disruptions and financial instability. |

| 🏛️ Political Solutions | Solutions require political negotiation and compromise between parties. |

Frequently Asked Questions

▼

The debt ceiling is a limit on the total amount of money the U.S. government is authorized to borrow to meet its existing legal obligations, including Social Security, Medicare, military salaries, and interest on the national debt.

▼

If the debt ceiling is not raised, the U.S. government will not be able to pay all of its bills. This could lead to a default on its obligations, which would have serious economic consequences.

▼

The debt ceiling has been raised or suspended numerous times since its creation during World War I, reflecting the country’s growing economy and increasing financial obligations over the years.

▼

Solutions include raising the debt ceiling with or without spending cuts, reforming the budget process, or finding bipartisan agreements on fiscal policy to manage the nation’s debt sustainably.

▼

The debt ceiling debate can create uncertainty in global markets if a default risk becomes significant, because U.S. Treasury securities are considered a benchmark for global finance.

Conclusion

The national debt ceiling debate continues to be a critical issue with potentially significant consequences for the U.S. and global economies. Understanding the stakes and potential outcomes is crucial for policymakers and citizens alike to ensure responsible fiscal management and economic stability.