New Corporate Tax Rate: Impact on US Business Investments in 2025?

The new corporate tax rate in 2025 is poised to significantly influence US business investments, potentially reshaping corporate strategies for expansion, capital expenditure, and international competitiveness, with experts forecasting varied impacts across sectors based on their tax burden and economic resilience.

The economic landscape for businesses in the US is constantly evolving, driven by myriad factors from technological advancements to global market shifts. Among these, tax policy stands as a formidable force, capable of recalibrating corporate strategies and investment decisions. A pivotal question for leaders and investors alike is: Is the new corporate tax rate impacting US business investments in 2025? As we approach this fiscal milestone, understanding the potential ramifications of these changes becomes paramount for navigating the complexities of the modern economy.

Understanding the Shift in Corporate Tax Policy

The year 2025 marks a significant juncture for US corporate taxation, with new rates coming into effect that diverge from previous fiscal frameworks. These changes are not merely minor adjustments but represent a deliberate policy shift aimed at achieving various economic objectives, ranging from balancing the federal budget to encouraging specific types of corporate behavior. Before delving into the projected impacts, it’s crucial to grasp the fundamental alterations being introduced.

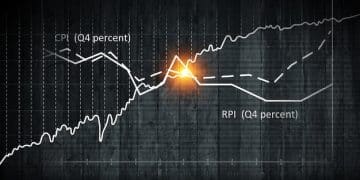

Historically, corporate tax rates in the US have seen considerable fluctuations, reflecting changing political priorities and economic theories. The recent adjustments are a continuation of this dynamic, moving from one set of parameters to another in a bid to optimize economic output. This shift often involves complex legislative processes, detailed economic modeling, and extensive debates among policymakers and industry stakeholders.

Historical Context of US Corporate Taxation

To fully appreciate the current changes, a brief look back at the trajectory of US corporate tax rates is helpful. The 2017 Tax Cuts and Jobs Act (TCJA) dramatically lowered the corporate tax rate from 35% to 21%, a move intended to stimulate economic growth and enhance America’s global competitiveness. This reduction led to a demonstrable increase in corporate profits and, to some extent, in capital investments, though the extent of its impact on wages and overall economic growth remains a subject of ongoing debate among economists.

The current legislative push seeks to perhaps reverse some of these trends or at least recalibrate the balance. The proposed increases or structural changes in the tax rate for 2025 are presented as a means to address budget deficits, fund infrastructure projects, or promote social welfare programs. Understanding these historical precedents and their stated objectives provides a necessary backdrop for analyzing the implications of the upcoming changes.

- Low corporate tax rates historically aimed to boost domestic investment and job creation.

- High corporate tax rates were often justified by the need to fund public services and redistribute wealth.

- The 2017 TCJA significantly lowered rates, sparking debate over its long-term economic efficacy.

The move towards new corporate tax rates in 2025, whether an increase or a restructuring, presents a multifaceted challenge for businesses. They must not only adapt to higher or differently structured tax burdens but also re-evaluate their investment strategies in light of these new realities. This foundational understanding of the policy shift is the first step in assessing its broad economic consequences.

Immediate Reactions and Business Sentiment

The announcement and subsequent discussions surrounding the new corporate tax rate for 2025 have already triggered a diverse range of reactions across the US business landscape. From multinational corporations to small and medium-sized enterprises (SMEs), leaders are grappling with the potential implications for their bottom lines, strategic planning, and overall market positioning. This immediate sentiment offers early insights into how the changes might affect investment behavior.

Many large corporations, particularly those with significant domestic operations and high profitability, have expressed concerns about the potential for reduced earnings and, consequently, diminished capacity for reinvestment. These companies often operate with tight margins in competitive global markets, and any increase in their tax obligations could force a re-evaluation of expansion plans, research and development budgets, and hiring strategies.

Impact on Major Industries

Different sectors are bracing for varying levels of impact. Technology companies, often characterized by high growth and significant intellectual property, might find their tax liabilities altered in complex ways, especially if the new policies target specific types of revenue or offshore earnings. Manufacturing industries, on the other hand, which frequently rely on substantial capital expenditures for machinery and facilities, could see their investment decisions directly influenced by changes in depreciation rules or tax credits.

Smaller businesses, while often subject to different tax regulations than their larger counterparts, are also sensitive to macroeconomic shifts. If larger corporations scale back investments, it could create ripple effects throughout the supply chain, affecting contracts, demand for services, and overall economic activity. This interconnectedness means that even businesses not directly impacted by the new corporate tax rate might still feel its indirect effects.

- Technology sector may face changes related to intellectual property and global earnings.

- Manufacturing industries could adjust capital expenditure due to new depreciation rules.

- Small businesses may experience indirect effects through supply chain disruptions.

Qualitative feedback from business surveys and executive interviews suggests a cautious but not entirely pessimistic outlook. While there are undeniable concerns about increased costs, many businesses are also exploring opportunities to innovate, optimize their operations, or even relocate certain functions to maintain competitiveness. The immediate reactions underscore the need for adaptability and strategic foresight in the face of evolving fiscal policies.

Economic Theories and Predicted Outcomes

Economists and policy analysts are employing various models and theories to predict how the new corporate tax rate will influence US business investments in 2025. The interplay of taxation, capital allocation, and economic growth is a complex field, with different perspectives offering distinct conclusions. Understanding these theoretical frameworks helps in elucidating the potential outcomes.

One prevalent theory suggests that higher corporate taxes act as a disincentive to investment. According to this view, an increased tax burden reduces the after-tax return on capital, making new projects, expansions, and research and development less attractive. This perspective often emphasizes the mobility of capital; if the US tax environment becomes less favorable, businesses might opt to invest in countries with lower tax rates or more generous incentives, potentially leading to capital flight and reduced domestic job creation.

Supply-Side Economics vs. Demand-Side Economics

Supply-side economics typically argues for lower corporate taxes, positing that such reductions stimulate investment, boost productivity, and ultimately lead to broader economic growth, even if initially reducing government revenue. Proponents of this view would predict that an increase in the corporate tax rate in 2025 would likely dampen investment, causing a slowdown in economic expansion and job creation.

Conversely, demand-side economics often emphasizes the role of government spending and public investment in fostering economic growth. While not necessarily advocating for higher corporate taxes as a primary tool, this perspective might view increased tax revenues from corporations as a means to fund infrastructure, education, or social programs that indirectly support businesses by creating a more educated workforce, improving logistics, or stimulating consumer demand. From this viewpoint, a well-placed increase in tax revenue could ultimately benefit businesses through a more robust economic environment, even if individual corporate tax burdens rise.

- Supply-side theory suggests higher taxes reduce investment and growth.

- Demand-side theory sees tax revenue as a means to fund growth-boosting public services.

- The actual impact often depends on how tax revenues are utilized by the government.

Another key consideration is the incidence of corporate taxation – who ultimately bears the burden of the tax. While formally levied on corporations, some economists argue that these taxes are eventually passed on to consumers through higher prices, to workers through lower wages, or to shareholders through reduced dividends and stock values. The extent to which these costs are passed on can influence investment behavior differently across sectors.

Ultimately, the actual economic outcome will likely be a blend of these theoretical predictions, influenced by the specific design of the tax policy, the prevailing global economic conditions, and the adaptive strategies of businesses. Policymakers must carefully weigh these theories and potential impacts to craft tax legislation that achieves its intended goals without inadvertently harming the broader economy.

Impact on Capital Investment and Job Creation

The relationship between corporate tax rates and capital investment is often considered direct: lower taxes typically encourage more investment, while higher taxes can deter it. However, the exact magnitude and nuances of this relationship are complex, particularly when considering job creation. For 2025, the new corporate tax rate is expected to have a palpable effect on how US businesses allocate capital and, consequently, on their capacity to generate employment.

From a corporate finance perspective, investment decisions are significantly influenced by the expected return on investment (ROI) after taxes. If the new tax rate lowers the net ROI of a potential project, a company might defer, downsize, or even cancel that investment. This could manifest in several ways: delay in purchasing new machinery, postponement of factory expansions, reduced spending on advanced technology, or a decrease in research and development initiatives.

Direct and Indirect Effects on Employment

The impact on job creation is often a direct follow-on from capital investment. When businesses invest in expansion, they typically need to hire more employees to staff new facilities, operate new equipment, or manage increased production. Conversely, if investment slows, so too might the pace of hiring. Beyond direct employment within the investing firm, there are also significant indirect effects across the supply chain, as increased demand for materials, components, and services supports jobs in other companies.

Moreover, the type of investment matters. Investment in automation, while boosting productivity, might initially lead to job displacement in some areas while creating new, higher-skilled jobs in others. Policymakers often try to use tax incentives to direct investment towards specific types of projects, such as those that are environmentally friendly or create high-wage jobs in targeted industries.

- Reduced after-tax ROI can lead to deferred or canceled capital projects.

- Slower capital investment directly impacts the rate of new job creation.

- Indirect job creation through supply chains also suffers when investment declines.

The debate surrounding the new corporate tax rate often centers on whether the benefits of increased government revenue (e.g., for public works or deficit reduction) outweigh the potential slowdown in private sector investment and job growth. Businesses, meanwhile, will be meticulously analyzing the new tax provisions to identify any remaining incentives or opportunities that can mitigate the increased cost of doing doing business and maintain their competitive edge in a dynamic labor market.

Global Competitiveness and Foreign Investment

In an increasingly interconnected global economy, tax policy is not merely a domestic concern; it is a critical determinant of a nation’s competitiveness on the international stage. The new corporate tax rate in the US for 2025 will inevitably influence how American businesses compete globally and how attractive the US remains as a destination for foreign direct investment (FDI).

A higher corporate tax rate in the US, especially if it exceeds those of major trading partners or competing economies, could place American companies at a disadvantage. It might raise the cost of doing business in the US, making US-produced goods and services more expensive compared to those from countries with lower tax burdens. This could affect export volumes and the profitability of US firms operating in international markets.

Attracting and Retaining Foreign Direct Investment

Foreign direct investment is a crucial driver of economic growth, bringing capital, technology, and jobs into a country. When the US tax rate rises, it could make other nations with more favorable tax regimes more appealing to multinational corporations looking to establish or expand operations. This could lead to a decline in FDI into the US, impacting various sectors and regions that rely on foreign capital for growth and innovation.

Conversely, US multinational corporations might find it more attractive to reinvest their foreign earnings abroad if the domestic tax rate increases significantly. This ‘profit shifting’ or strategic allocation of resources is a common tactic to optimize tax liabilities, but it can reduce the amount of capital available for domestic US investments. The structure of international tax rules, such as those governing foreign tax credits and repatriation of earnings, will play a significant role in these decisions.

- Higher US corporate taxes can make US goods less competitive globally.

- Increased tax rates may deter new foreign direct investment into the US.

- US multinationals might choose to reinvest profits overseas to minimize tax burden.

Policymakers must carefully balance the goal of generating domestic revenue with the imperative of maintaining global competitiveness. A tax regime that discourages investment or encourages capital outflow could have long-term negative consequences for the US economy, diminishing its innovative capacity and its standing as a leading global economic power. The choices made for the 2025 corporate tax rate will send a strong signal to international investors and reshape the global financial landscape.

Sector-Specific Analysis and Adaptation Strategies

While the new corporate tax rate for 2025 will have broad economic implications, its impact will not be uniform across all sectors of the US economy. Different industries possess unique financial structures, profit margins, and reliance on capital investment, meaning their adaptation strategies will also vary significantly. A granular analysis reveals that some sectors may face harsher challenges, while others might be relatively insulated or even find new opportunities.

For instance, industries characterized by high capital intensity, such as manufacturing, telecommunications, and energy, are likely to be more sensitive to changes in corporate tax rates. These sectors often rely on substantial, long-term investments in infrastructure and equipment, and a higher tax burden could significantly alter the feasibility and profitability of such projects. Their adaptation strategies might involve lobbying for specific industry-based tax credits or exploring advanced depreciation methods to mitigate increased costs.

Service Industries vs. Goods-Producing Industries

Service industries, particularly those with lower capital requirements and higher labor costs (e.g., professional services, healthcare, creative industries), might experience a different set of challenges. Their primary concerns might revolve around the availability of skilled labor, consumer disposable income, and the overall health of the domestic economy rather than direct capital expenditure. For these sectors, a higher tax rate could impact profitability but might not alter investment strategy as profoundly as it would for a manufacturing firm.

Conversely, sectors heavily reliant on research and development (R&D), such as pharmaceuticals and high-tech, may be particularly attuned to tax provisions related to R&D credits. Any changes to these incentives, coupled with a higher general corporate tax rate, could influence their investment in innovation, potentially affecting their long-term growth prospects and the country’s technological leadership. These companies might intensify their focus on optimizing R&D spending to maximize tax benefits.

- Capital-intensive sectors (e.g., manufacturing) are highly sensitive to tax rate changes.

- Service industries may focus on labor costs and consumer demand over capital investment.

- R&D-heavy sectors will prioritize tax incentives related to innovation and development.

All sectors will likely engage in increased financial planning and tax optimization strategies. This could include restructuring corporate entities, reassessing international operations, or optimizing internal investments to qualify for any available tax breaks or deferrals. The ability of businesses to innovate their financial strategies will be as crucial as their operational agility in adapting to the new fiscal environment of 2025.

Navigating the Future: Strategies for Businesses and Policymakers

As the new corporate tax rate for 2025 approaches, both businesses and policymakers face critical decisions that will shape the economic trajectory of the US. Effective navigation of this fiscal change requires foresight, strategic planning, and a willingness to adapt on all fronts. For businesses, this means re-evaluating existing models and exploring new opportunities, while for policymakers, it involves vigilant monitoring and potential adjustments to ensure desired economic outcomes.

For businesses, the primary strategy will be meticulous financial planning and risk assessment. Companies will need to perform detailed analyses of how the new tax rate impacts their specific operations, cash flow, and profitability. This includes scenario planning to understand the best and worst-case outcomes and developing contingency plans. Maximizing efficiency in all areas, from supply chain management to operational expenditures, will become even more critical to offset any increased tax burden.

Policy Adjustments and Economic Oversight

Policymakers, on their part, must maintain a close watch on the economic indicators following the implementation of the new tax rate. This includes monitoring capital investment trends, employment figures, GDP growth, and foreign direct investment flows. If the tax changes prove to have unintended negative consequences, a flexible approach will be necessary, potentially leading to further legislative adjustments or the introduction of targeted incentives to stimulate specific sectors or types of investment.

Furthermore, effective communication between the government and the private sector will be vital. Businesses need clarity and predictability in tax policy to make long-term investment decisions. Policymakers can foster a more stable environment by engaging in open dialogue, seeking feedback from industry leaders, and providing clear guidance on the interpretation and application of new tax laws. This collaborative approach can help mitigate uncertainty and build confidence within the business community.

- Businesses must engage in detailed financial planning and efficiency improvements.

- Policymakers need to monitor economic indicators and be prepared for adjustments.

- Open communication between government and businesses is crucial for stability.

The long-term health of the US economy hinges on a dynamic balance between governmental needs and private sector vitality. The new corporate tax rate in 2025 represents more than just a fiscal adjustment; it is a test of how effectively the nation can adapt its economic framework to meet evolving challenges and opportunities. Successful navigation will depend on strategic foresight, transparent governance, and resilient corporate adaptability.

The Future Landscape: Long-Term Projections and Adaptations

Looking beyond the immediate reactions, the new corporate tax rate in 2025 is expected to usher in a future landscape where long-term strategic adaptations become normalized for US businesses. These changes are not just about one-time adjustments but about building resilience and finding new ways to thrive within a revised fiscal framework. Understanding these long-term projections is crucial for sustainable growth and competitiveness.

One significant long-term projection is an increased focus on operational efficiency and technological adoption. Faced with potentially higher tax burdens, companies will be incentivized to invest in automation, artificial intelligence, and other innovations that reduce operational costs and enhance productivity. While this may lead to some initial job displacement in certain areas, it could also foster the creation of new, higher-skilled positions and boost overall economic output.

Reshaping Corporate Structures and Investment Hubs

The new tax rate may also contribute to a reshaping of corporate structures and a re-evaluation of international investment hubs. Some companies might explore consolidating functions, decentralizing operations, or even relocating parts of their business to jurisdictions within or outside the US that offer more favorable tax conditions. This strategic restructuring would aim to optimize their global tax footprint while maintaining market access and operational effectiveness.

Moreover, there could be a long-term shift in the types of investments prioritized. Investments that offer quicker returns, are less capital-intensive, or are eligible for specific tax credits might become more attractive. Businesses may also increase their lobbying efforts to advocate for tax policies that better suit their specific industry needs, leading to continuous dialogue and potential future adjustments in tax legislation.

- Operational efficiency and technological adoption will be prioritized for cost reduction.

- Corporate structures and international investment strategies may be re-evaluated.

- Future investments might favor quicker returns, less capital-intensive projects, or tax-credit eligible ventures.

Ultimately, the long-term impact of the new corporate tax rate will depend on its interaction with other economic factors, including global trade policies, technological advancements, and consumer behavior. Companies that are agile, innovative, and maintain a strategic focus on their core competencies will be best positioned to adapt and prosper in this evolving fiscal environment, demonstrating that even significant tax changes can be navigated with the right long-term vision.

| Key Point | Brief Description |

|---|---|

| 💰 Tax Rate Changes | New corporate tax rates for 2025 are a significant policy shift, influencing business profitability and investment capacity. |

| 📈 Investment Impact | Higher taxes may reduce after-tax ROI, potentially leading to deferred or scaled-back capital expenditures and R&D. |

| 🌍 Global Competition | Increased US rates could affect global competitiveness and potentially deter foreign direct investment. |

| 📊 Adaptation Strategies | Businesses will focus on efficiency, technological adoption, and strategic restructuring to adapt to new fiscal realities. |

Frequently Asked Questions

The primary changes involve an adjustment to the statutory corporate income tax rate, potentially increasing it from current levels or introducing new surcharges and specific deductions. These changes are part of broader fiscal policies aimed at revenue generation and economic rebalancing. Businesses are closely watching legislative developments for precise details that will affect their financial planning.

A higher corporate tax rate can reduce the after-tax return on investment (ROI) for businesses. This might lead companies to defer or scale back capital expenditures, such as expansions, equipment purchases, and research & development, making potential projects seem less financially viable. The extent of this impact depends on the magnitude of the tax increase and existing economic conditions.

Yes, a higher US corporate tax rate could potentially make the country less attractive for foreign direct investment (FDI) compared to nations with lower tax burdens. Multinational corporations may re-evaluate where to allocate capital, potentially diverting investment to countries offering more favorable tax regimes, impacting job creation and economic growth in the US.

Businesses can adopt several strategies, including enhancing operational efficiency, increasing investments in automation and technology to reduce costs, meticulously planning tax liabilities, and possibly restructuring operations to optimize their global tax footprint. They will also need to engage in proactive financial modeling to understand and mitigate potential impacts on profitability and cash flow.

While often subject to different tax calculations, small businesses can be indirectly affected by changes impacting larger corporations. Reduced investment from big companies can impact supply chains and overall market demand. Small businesses might also face a more competitive environment if capital becomes scarcer or if larger firms pass on increased costs, potentially affecting their growth prospects.

Conclusion

The impending new corporate tax rate in 2025 represents a critical inflection point for US businesses. Its potential to reshape investment strategies, influence job creation, and alter America’s global economic standing is significant. While some sectors may face considerable challenges, others might adapt with greater agility, spurred by a renewed focus on efficiency and innovation. The full extent of its impact will unfold over time, but proactive planning and a clear understanding of its multifaceted implications will be crucial for both corporate leaders and policymakers. The ongoing dialogue between government and industry will be key to navigating this future landscape, ensuring that the US economy remains robust and competitive.